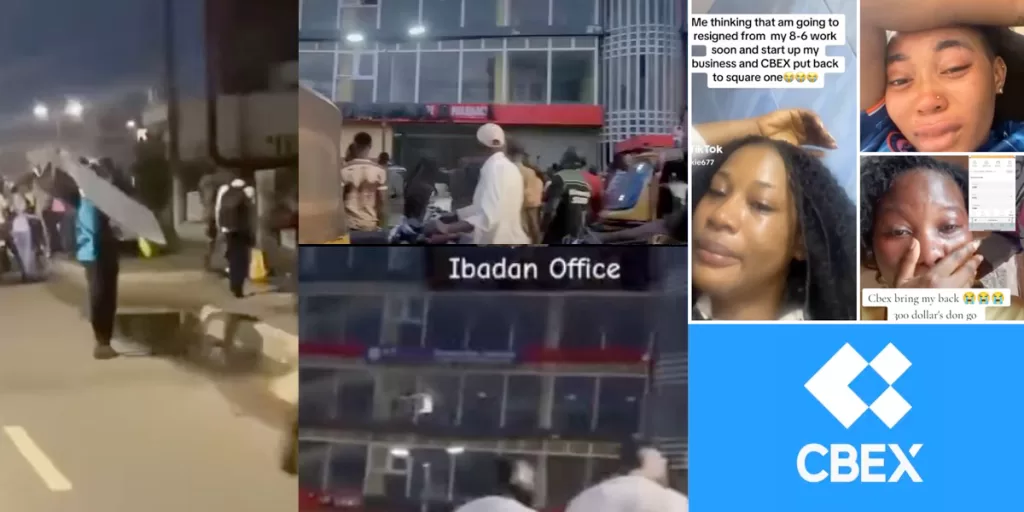

IBADAN — Tensions escalated in Oke Ado, Ibadan, on Monday as angry investors stormed the local office of a fraudulent online trading platform that branded itself as “CBEX.” The outrage followed the platform’s sudden collapse and reports that it had wiped out over ₦1.3 trillion in investor funds.

Eyewitnesses reported scenes of chaos as the crowd broke into the office, looting electronics, furniture, and documents. A video circulating on social media shows dozens of people forcibly entering the premises and hauling out items — a reaction to what many now consider one of Nigeria’s largest digital frauds in recent memory.

The platform — which positioned itself as an AI-driven asset trading hub promising up to 100% returns within 30 days — had attracted thousands of unsuspecting Nigerians with slick dashboards, inflated profit displays, and aggressive marketing. But over the weekend, users found their digital wallets emptied, and all CBEX Telegram groups suddenly locked.

Shortly after the crash, the platform introduced a dubious “verification fee” ranging from $100 to $200, depending on how much users had invested — a move experts say is a classic tactic used to prolong Ponzi operations by extracting one final round of cash from desperate victims.

How the Scam Worked

Investigations reveal that the platform, which operated without a license, mimicked the interface of legitimate global exchanges like ByBit to appear credible. However, user deposits were funneled into a private TRX (Tron) wallet, instantly converted to USDT, and then to Ethereum (ETH) — making it nearly impossible to trace or retrieve the funds.

According to blockchain analysis, over $847 million had been moved to a private ETH wallet before the crash, with no evidence that any real trading ever occurred. The returns displayed on user dashboards were entirely fabricated — fake data designed to encourage reinvestment and referrals.

Regulatory Alarm Bells Ring

In a swift response, Nigeria’s Securities and Exchange Commission (SEC) reiterated its warning against investing in unregistered platforms. Under the newly signed Investments and Securities Act (ISA) 2025, all digital asset exchanges must be registered and regulated by the SEC.

Dr. Emomotimi Agama, Director General of the Commission, described the CBEX incident as “a wake-up call” for tighter enforcement and digital investor education.

“Investor protection remains our top priority. Anyone operating without SEC registration is acting illegally. Nigerians must take extra care to verify platforms before investing,” he said.

Unanswered Questions, Mounting Losses

As of press time, law enforcement authorities had not issued an official statement regarding the incident, and no arrests had been confirmed. Civil society groups are demanding urgent action from the Economic and Financial Crimes Commission (EFCC) to investigate and prosecute those behind the platform.

Meanwhile, online forums are flooded with emotional testimonials from victims — many of whom invested their life savings. Analysts say the psychological damage may rival the financial losses.

What Comes Next?

Financial analysts and tech regulators are calling for a nationwide digital literacy campaign and stronger collaboration between Nigerian regulators and international blockchain watchdogs.

For now, CBEX joins a growing list of high-yield investment schemes that have exploited regulatory gaps in Africa’s fintech ecosystem — with ordinary Nigerians left to pick up the pieces.